Category

Sales

Date

Nov 23, 2025

Author

Asher Flowers

Every so often, a founder reaches out with the kind of optimism that only comes from believing you’ve cracked the code:

“Let’s test the market. One BDM. Thirty days. If the product’s good enough, it’ll climb the mountain on its own.”

On the surface, it feels pragmatic - a light-touch, low-risk approach to exploring a market. But underneath that simplicity sits a far more persistent misunderstanding about how commercial growth actually works. Growth has never come from isolated bursts of activity or from a brief surge of enthusiasm; it emerges from the discipline of systems, from the quiet routines that compound over time, and from the slow accumulation of commercial intelligence and repetition.

Whether you’re building a drinks brand, structuring a sales organisation, or trying to run a basketball dynasty, the pattern is identical: systems beat improvisation, systems beat individual talent, and systems - applied consistently - are what build dynasties.

The Myth of the Quick Win

The drinks industry still carries the legacy of reactive behaviour: a strong month here, a fortunate placement there, a distributor who shows early interest, or the hope that one successful visit will cascade into sustained traction. But the truth is that field sales do not accelerate through occasional moments; they accelerate through rhythm, consistency, and the compounding effect of repeated interactions.

Anyone who has asked a BDM to “cover Manhattan” in a single week will recognise the problem. On a map, the neighbourhoods look close enough to be manageable, but markets that appear adjacent in distance can be worlds apart in terms of culture, pricing dynamics, customer expectations and even the tempo of service. A 12-minute ride on the subway may seem trivial, but multiply it across a full week and it becomes the difference between a BDM spending their time selling - or simply moving between places where selling might happen.

When coverage stretches beyond what’s commercially sensible, follow-up becomes inconsistent, relationships never quite deepen, and the momentum required to build a healthy pipeline simply never takes hold. Research into sales territory design has been remarkably consistent on this point: overextending reps doesn’t create more opportunities - it erodes the ones they could have converted.

Short-term contracts amplify the problem, because the brand expects velocity long before the market has even registered its presence. Even if the early adopters respond, the broader decision-making cycle in trade is slower, more deliberate, and far more dependent on pattern recognition than most founders anticipate.

Ask yourself which new brand you saw a month ago that truly stayed with you. The answer - for most - is none.

Business development does not reward impatience. As the Institute of Sales Professionals observed, it takes months and years for a strategy to reveal its full potential. The belief that a BDM can embed, generate meaningful traction, and establish reorder velocity within a month is not ambitious; it is structurally unworkable.

Why Territory Focus Is Not a Preference - It Is the Foundation

At Lateish, territory design is not an admin task or a logistical map-drawing exercise. It is infrastructure. A coherent territory, paired with a BDM whose experience and relationships have actual relevance to that geography, creates the conditions in which consistent commercial behaviour can take place: regular touches, repeated follow-up, distributor coordination, structured reporting and a rhythm that the market begins to recognise.

A model built around one BDM, one market, category exclusivity and a disciplined cadence of outreach may sound simple, but research from Abacum, Gong and the Alexander Group all point to the same conclusion: clarity of territory dramatically improves the depth of coverage and the long-term revenue outcome.

The underlying logic is straightforward. A scattered BDM becomes reactive, jumping from neighbourhood to neighbourhood in response to whichever lead feels urgent. A focused BDM develops compounding intelligence - who is buying, who is nearly buying, who needs a tasting, who is waiting on pricing, and who simply requires a nudge. Focused repetition builds instinct, and instinct accelerates conversion.

The Commercial Logic: Why Systems Are Cheaper Than Chaos

Too often, founders underestimate the economic cost of a non-system. When a BDM spends their time travelling rather than selling, the cost-per-case quietly rises. When distributors are unsure of where and how a brand is being supported, purchase orders stall. When coverage is scattered across multiple districts, no single area receives enough repetition for volume to build. And when the weekly pipeline resets because nothing has been nurtured long enough to mature, the brand effectively starts again every Monday.

Systems work because they reduce these inefficiencies. A focused territory lowers cost-per-case, because time is spent on trade, not transit. Repetition leads to reorder velocity. Distributor teams understand where the brand is positioned. And each week reinforces the last, rather than erasing it.

Commercially, there is no comparison: a system will always outperform improvisation.

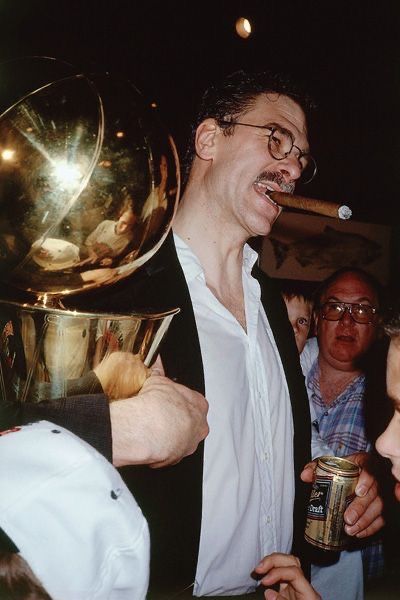

Why Phil Jackson Understood Sales Better Than Most Founders

Phil Jackson’s 11 championships are often attributed to the talent he coached. But Jackson and Tex Winter understood something deeper: talent without system is unpredictable. Talent within a system becomes extraordinary.

The Triangle Offense was not a playbook - it was an operating framework designed to remove uncertainty from decision-making. Spacing, roles, rotations and patterns were consistent enough that players could act with instinct, because they no longer needed to guess where anyone else was meant to be.

That is the essence of systems thinking: structure does not restrict creativity - it unlocks it.

Field sales works in precisely the same way. A BDM spread across three boroughs cannot form the mental map required to anticipate buyer behaviour. They cannot detect the rhythms that drive reorder cycles. They cannot identify which accounts are ready for conversion, because they never spend long enough in one place to develop commercial intuition.

You don’t run the Triangle Offense for one quarter and expect championship-level cohesion. And you don’t run field sales for thirty days and call it a market entry.

A Tale of Two Launches

Those within Lateish have seen it time and time again.

Brand A enters with focus: one BDM, a defined cluster of ZIPs, structured follow-up, and distributor coordination. Within three months, they have early velocity accounts, recognisable patterns of reorder, and a pipeline that grows as the market begins to understand the brand’s presence.

Brand B enters scattered: dipping into Manhattan one week, Brooklyn the next, then flying west to “see what happens.” Three months later, the listings are inconsistent, the reorder cycle never forms, distributors can’t detect momentum, and the founder concludes the market is “difficult.”

Brands can scale across multiple Lateish markets - Manhattan, Brooklyn, Orange County, Columbus - but only when the operating rhythm stays consistent. The advantage of scaling through Lateish is the shared intelligence: case studies from live territories, rapid knowledge transfer between BDMs, and a team that already knows what serves, POS, brand stories or trial mechanics are building velocity. Momentum is created the same way everywhere: boots on the ground, structured cadence, disciplined follow-up, and follow-through that compounds into trust and performance.

Infrastructure Before Impact

Everything we do at Lateish rests on one belief: you earn the right to scale by building the infrastructure first.

Defined territories, category exclusivity, structured weekly rhythm, measurable reporting, real-time distributor alignment, disciplined prioritisation and a platform that holds all of it together - these are the conditions that allow a brand to compound.

Without a system, the market forgets you every seven days.

With a system, every week builds on the last.

Why We Are Building SaaS - and Why Systems Need a Platform

A system is only as strong as its visibility. Without a platform, it becomes dependent on memory, spreadsheets and the individual habits of each BDM.

Lateish.co formalises the structure:

real-time account tagging

distributor interaction tracking

pipeline forecasting

territory heatmapping

weekly activity rhythm

cost-per-case visibility

prioritisation tools for every market

A&P and ROI modelling

It is the operational layer that ensures the system repeats itself, regardless of market, BDM or brand. It removes ambiguity and creates a shared truth about what is happening in the field.

The Data Is Unequivocal

Three independent studies published within the last year all lean in the same direction:

Default found that companies can increase total sales by up to 20% within three years simply by optimising territory plans.

The Alexander Group’s Craig Ackerman reports that well-balanced territories deliver 10–20% increases in sales productivity, often alongside reduced selling costs.

Gartner’s GTM research shows that consistent territory focus shortens sales cycles by 15–25%.

Collectively, the evidence is overwhelming: systems are a competitive advantage.

For Founders Reading This

The question is rarely whether the product is good enough. The question is whether the approach gives the product the system it needs to succeed.

If you want to understand what a structured, territory-led launch looks like - and how it applies to any US or global market - we can walk you through it.